Co-signing a timeshare loan might seem like helping someone out, but it comes with serious financial and legal risks. If the primary borrower defaults, you’re fully responsible for the debt, including payments, fees, and even foreclosure consequences. Here’s what you need to know:

- Full Liability: As a co-signer, you’re legally obligated to cover missed payments, maintenance fees (averaging $1,480/year per week), and other costs. Lenders can pursue you directly, even before the borrower.

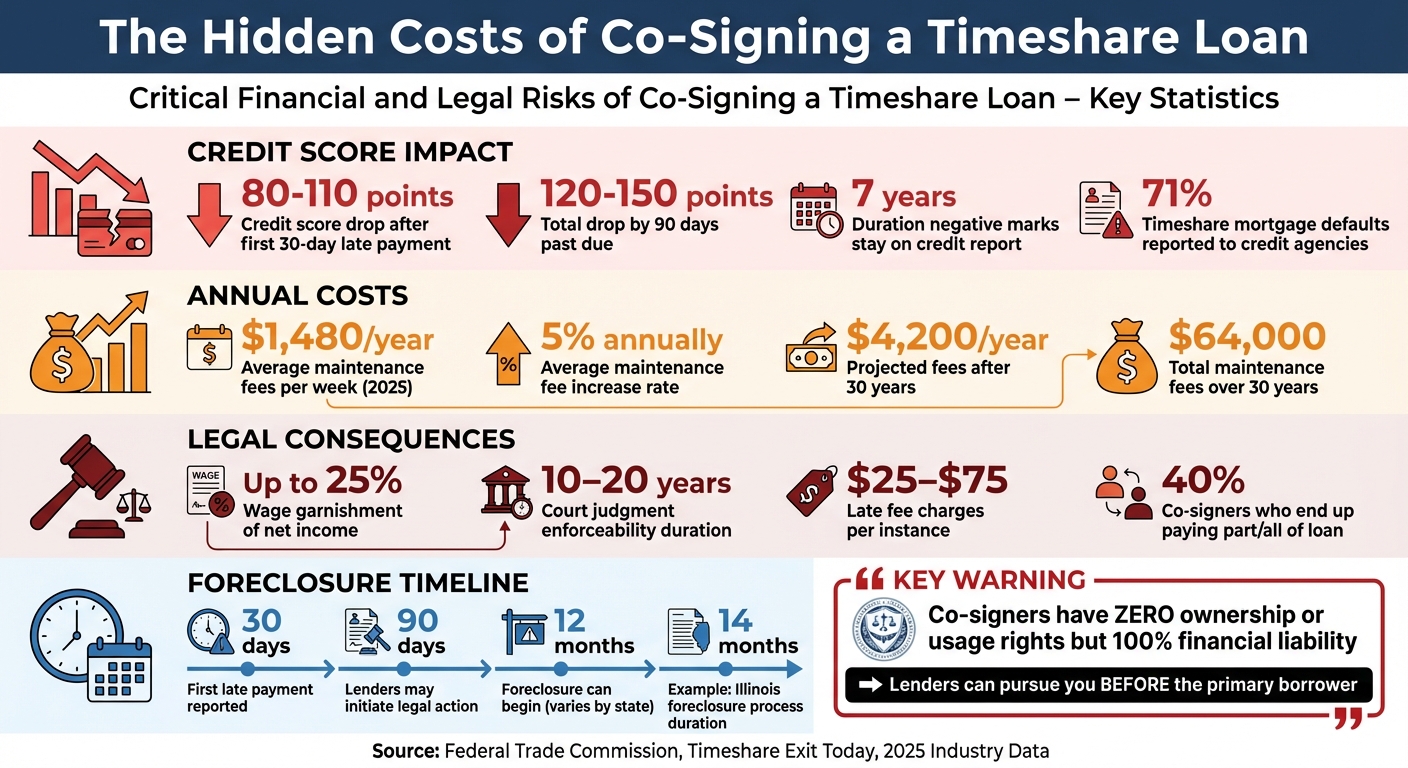

- Credit Damage: A single missed payment can drop your credit score by 80–110 points. Defaults stay on your credit report for 7 years, impacting loans, credit cards, and even job opportunities.

- Ongoing Costs: Timeshare agreements often include lifetime commitments to rising maintenance fees, property taxes, and special assessments – even after the loan is paid off.

- Legal Risks: Foreclosure, deficiency judgments, wage garnishment, and tax liabilities (via a 1099-C form) are common outcomes of defaults.

- Limited Protection: Co-signers have no ownership or usage rights but share full financial responsibility. State laws and contract terms can further complicate your liability.

If you’re already facing a timeshare default, options like negotiating repayment plans, contract cancellation, or bankruptcy may help. Always consult legal professionals before signing or taking action, and carefully review contracts to avoid long-term financial traps.

Financial Impact of Co-Signing a Timeshare Loan: Key Statistics and Risks

How Timeshare Loan Co-Signing Works

What Is a Timeshare Loan Co-Signer?

A co-signer is someone who takes on the responsibility of repaying a loan if the primary borrower fails to do so. However, co-signers don’t receive any ownership or usage rights tied to the loan. The Federal Trade Commission explains it clearly:

"Cosigning a loan doesn’t give you any title, ownership, or other rights to the property the loan is paying for." – Federal Trade Commission

Timeshare developers often require co-signers when the primary borrower has a low income, poor credit, or limited credit history. In most cases, family members – like parents co-signing for their children – step into this role. Unlike co-borrowers who share ownership and usage rights, co-signers are there purely to provide financial security for the lender. This arrangement carries significant risks, which we’ll delve into further when discussing liability and legal consequences.

Joint and Several Liability Explained

If you’re a co-signer, joint and several liability means you can be held responsible for the entire loan balance, including fees, even if the lender hasn’t attempted to collect from the primary borrower first.

"The creditor can collect this debt from you without first trying to collect from the borrower. The creditor can use the same collection methods against you that can be used against the borrower, such as suing you, garnishing your wages, etc." – Federal Trade Commission

Lenders typically go after the person who is most likely to pay – often the co-signer with better credit or a more stable income. If you end up covering the full debt, you do have the right to seek repayment from the primary borrower. However, pursuing this through legal channels can be challenging, especially if the borrower is unable to pay.

Common Causes of Timeshare Defaults

Timeshare loan defaults often happen due to unexpected life events like job loss, reduced income, medical emergencies, or rising maintenance fees. In many cases, the co-signer only learns about the default when collection agencies start calling or when their credit score takes a hit – because any missed payment affects both the borrower and the co-signer immediately.

Maintenance fees are another frequent issue. These fees average about $1,480 per year for a one-week timeshare interval (as of 2025) and can increase over time. Even if the loan payments are current, unpaid maintenance fees can lead to serious consequences. For instance, some timeshare associations are allowed to initiate foreclosure after just one year of unpaid fees. In states like Arizona, a nonjudicial trustee’s sale can begin once assessments are delinquent for 12 months.

Federal law requires lenders to provide co-signers with a "Notice to Cosigner", which warns them that they can be held responsible for the loan immediately if the borrower defaults. Unfortunately, many co-signers don’t fully understand this until they face lawsuits or wage garnishments. These triggers can lead to significant financial and legal challenges, which will be explored further in the next section.

What Happens to Co-Signers When a Timeshare Loan Defaults

Financial Liability and Legal Action

When a timeshare loan defaults, co-signers are on the hook for the unpaid balance, including missed payments, interest, and fees (usually $25–$75 per instance). Lenders can skip over the primary borrower and go straight to the co-signer, especially if the co-signer has a stronger credit profile. They may even take legal action, like filing lawsuits to secure judgments. These judgments can lead to wage garnishment (up to 25% of net income), direct withdrawals from your bank account, or liens on other properties you own.

For instance, in March 2024, an Illinois resident named Michael faced the consequences of defaulting on his $18,000 timeshare mortgage. After stopping payments in January 2023, he went through a 14-month judicial foreclosure process. The result? A $24,500 deficiency judgment that included interest and legal fees. His credit score also took a nosedive, dropping from 720 to 565. This kind of financial fallout can severely impact your credit standing.

Credit Score Damage

Missing payments on a timeshare loan can quickly wreak havoc on your credit score. A single 30-day late payment can cause your FICO score to drop by 80–110 points. Each additional month of delinquency adds another 20–30 points to the damage. By the time you’re 90 days past due, your score could plummet by 120–150 points.

"Your FICO score drops 80-110 points after the first 30-day late payment report hits your credit file." – Timeshare Exit Today

The negative impact doesn’t stop there. Marks from a timeshare loan default stay on your credit report for seven years, making it harder to qualify for mortgages, car loans, or even credit cards. Statistics show that 71% of timeshare mortgage defaults are reported to credit agencies, compared to just 18% for maintenance fee-only defaults. Since payment history makes up 35% of your FICO score, a default can block you from securing a conventional home loan for three to seven years.

Deficiency Balances After Foreclosure

Foreclosure might seem like the end of the road, but it often leaves behind unresolved debt. If the timeshare is sold for less than what you owe – a common scenario – you’ll be responsible for the "deficiency balance": the difference between the sale price and your total debt, including fees.

"Some states allow the foreclosing bank to seek a personal judgment, which is called a ‘deficiency judgment,’ against the borrower for this amount." – Amy Loftsgordon, Attorney, Nolo

Whether lenders can pursue this balance depends on your state’s laws. For example, Florida has restrictions on deficiency judgments in certain situations, but many states allow lenders to chase borrowers for years. Court judgments can remain enforceable for 10 to 20 years, depending on the state. Even if the lender decides to write off the debt instead of pursuing you, they might issue a 1099-C form. This means the forgiven amount is treated as taxable income, potentially leaving you with an unexpected tax bill on top of everything else.

Legal Challenges Specific to Timeshare Co-Signers

Long-Term, Non-Cancellable Obligations

Timeshare contracts come with a unique set of challenges compared to traditional loans. While an auto loan might stretch over five years or a personal loan over three to seven years, timeshare agreements often lock you into a lifetime commitment. This means you’re not just responsible for the initial purchase price – you’re also tied to ongoing costs like maintenance fees, property taxes, and special assessments. And these costs don’t stay static. For example, maintenance fees alone can increase by 5% annually. What starts as a $980 fee in 2025 could balloon to over $4,200 per year after 30 years, adding up to about $64,000 in fees over time. Even if the mortgage is paid off, co-signers remain liable for these escalating costs. Falling behind on these payments can lead to serious consequences, including liens and foreclosure initiated by the timeshare association.

State Law Differences and Contract Terms

The risks tied to co-signing a timeshare are further complicated by state-specific laws and contract details. Your liability as a co-signer can vary widely depending on where the timeshare is located and the terms buried in the contract. For instance, in Florida, timeshares can be foreclosed through a nonjudicial process, which moves quickly and with little oversight – unlike residential foreclosures that require court involvement. Additionally, Florida law prevents lenders from pursuing a deficiency judgment after foreclosure if you don’t contest the process. However, in many other states, such protections don’t exist, leaving co-signers exposed to collection efforts for years.

States also differ in how quickly they allow foreclosure to proceed. In Arizona, for example, timeshare owners must be delinquent for a full year before the association can initiate a trustee’s sale. In contrast, other states may act much faster. The specific terms in the timeshare’s "Declaration of Covenants, Conditions, and Restrictions" detail when a lien can be placed on the property and outline additional charges – like late fees, interest, collection costs, and attorney fees – that co-signers could be responsible for.

Co-Signer vs. Co-Borrower Classification

Another critical factor is how your role is classified in the agreement, as it significantly affects your legal and financial responsibilities. Many people unknowingly sign as co-borrowers rather than co-signers, which comes with broader implications. A co-signer guarantees the loan but doesn’t have ownership rights or access to the timeshare. A co-borrower, however, is listed on the deed and has full ownership rights – along with the liabilities that come with them. This means co-borrowers are responsible not just for the mortgage but also for ongoing costs like maintenance fees, special assessments, and property taxes.

Both roles include joint and several liability, allowing lenders to pursue the entire debt from either party without first attempting to collect from the primary borrower. To avoid surprises, it’s crucial to confirm whether your name will appear on the deed. If it does, you’re considered a co-owner and take on expanded liability. Unlike auto or personal loans, which are governed by the Truth in Lending Act (TILA) and require clear disclosure of terms, many timeshare contracts don’t offer the same level of consumer protection. This lack of transparency can make it harder to fully understand the financial risks before signing, compounding the challenges co-signers face.

sbb-itb-d69ac80

Solutions for Co-Signers Facing Timeshare Default

Negotiating with Lenders or Developers

If you’re a co-signer dealing with a timeshare default, your first step should be reaching out to the timeshare company. Open the lines of communication to discuss possible solutions like forbearance, a repayment plan, or even a lump-sum settlement to avoid foreclosure.

A lump-sum payment could settle the debt entirely and prevent foreclosure proceedings. Another option might be a deed in lieu of foreclosure, where you return the title to the resort and end future obligations – though this depends on whether the resort agrees to it.

Make sure to document every agreement in writing and send correspondence via registered or certified mail. This creates a clear paper trail that can protect you if any disputes arise later on.

If negotiations don’t resolve your liability, you may need to consider canceling the contract.

Timeshare Contract Cancellation Options

If working with the lender doesn’t lead to a resolution, legal cancellation might be your next move. If you’re still within the rescission period – usually 3 to 15 days after signing – act fast and send a formal cancellation letter through certified mail.

If the rescission period has passed, cancellation could still be an option if there was fraud, misrepresentation, or a breach of contract involved. In these cases, specialized legal help becomes essential. Firms like Aaronson Law Firm, which focus solely on timeshare cancellations, can assess whether your contract qualifies for rescission. They offer free consultations, draft legal demand letters, and provide litigation support if necessary. They also include credit protection services to help safeguard your credit score during the process.

Before hiring a timeshare exit company, make sure to verify their legitimacy through the Better Business Bureau (BBB) and your state Attorney General. Be cautious – many exit firms charge upfront fees ranging from $5,000 to $80,000 or more, and some are outright scams. As timeshare expert Lisa Ann Schreier warns:

"There are a number of good guys in the market… But little if anything is being done to disassociate themselves from the bad guys, therefore the consumer is still, rightfully so, leery."

If neither negotiation nor cancellation works, bankruptcy might be your final option.

Bankruptcy as a Last Option

When all else fails, bankruptcy can help eliminate debts tied to your timeshare. Chapter 7 bankruptcy allows for quick discharge of debts by liquidating assets, while Chapter 13 restructures your debt over 3–5 years, enabling you to keep the property if your income allows.

However, keep in mind that maintenance fees may continue until the title is officially transferred. Attorney Cara O’Neill explains:

"If you want out of the monthly payments, you can surrender your timeshare and let it go back to the lender, but you’ll likely remain responsible for maintenance fees until the bank forecloses and transfers the title out of your name."

Bankruptcy should only be considered as a last resort, as it comes with serious consequences. Your credit score could drop by 100 points or more, and the bankruptcy will stay on your credit report for seven years. This could also impact your ability to secure jobs in industries that require credit checks, such as banking or financial services. Before filing, consult both a bankruptcy attorney and an accountant to understand any tax implications. For instance, if a lender writes off a deficiency balance, you might receive a 1099-C form, and the IRS could treat the canceled debt as taxable income.

Risk Prevention for Current and Future Co-Signers

Research Before Signing

Before co-signing, take the time to fully understand the financial responsibilities you’re agreeing to. Lenders are required to provide a Notice to Cosigner, which explains that you are guaranteeing the debt. This means you could be held liable for the entire amount, including late fees and collection costs, even if the lender hasn’t first pursued the primary borrower.

"You are being asked to guarantee this debt. Think carefully before you do. If the borrower doesn’t pay the debt, you will have to. Be sure you can afford to pay if you have to, and that you want to accept this responsibility." – Federal Trade Commission (FTC)

Factor in all costs, such as maintenance fees, special assessments, and travel expenses. For instance, by 2025, the average annual maintenance fee is projected to reach $1,480 per weekly interval, with increases that often outpace inflation. Since co-signers are typically sought when the primary borrower has insufficient credit or income, ask the borrower to provide a detailed budget. This will help you confirm they can manage the payments. Additionally, do your homework on the developer – check online for complaints about the resort developer or management company before committing.

Legal Review of Contracts

Always have an attorney review any timeshare contract before signing. These agreements often include complex legal language and can impose long-term financial commitments, which vary based on state and federal laws. Missing the short rescission window could leave you with no easy way out.

Law firms like Aaronson Law Firm offer free consultations to review timeshare contracts. Their attorneys can analyze key clauses such as fee escalation terms, resale restrictions, first right of refusal provisions, and deficiency judgment language. Make sure the contract clearly outlines your rescission rights. It’s also crucial to determine whether you’re classified as a co-signer or co-borrower, as this distinction impacts your legal rights and responsibilities. Keep in mind, co-signing doesn’t give you any ownership or usage rights to the timeshare – only the obligation to repay the debt.

After the legal review, continue protecting yourself by staying vigilant and maintaining clear communication.

Monitoring and Communication

Given the potential financial risks, regular monitoring is a must. Request written notices from the lender for any missed payments. Acting quickly in these situations can help you avoid loan default.

"If the borrower misses a single payment, the lender can collect from you immediately." – Florida Attorney General’s Office

Keep an eye on your credit reports to catch any issues, such as errors or missed payments, as soon as they arise. Statistics show that nearly 40% of co-signers end up responsible for part or all of the loan balance, so staying proactive is critical. Secure copies of all loan documents, including TILA disclosures, since lenders aren’t required to provide these to co-signers automatically. Maintain open communication with the borrower, and if problems occur, reach out to the lender to discuss options like forbearance or alternative payment plans. Once the debt is fully paid off, ensure the account is officially closed to avoid lingering liability.

Conclusion

Co-signing a timeshare loan places you on the hook for the entire debt, including any extra costs, from the moment you sign. If the primary borrower fails to pay, you’re legally obligated to cover the full amount. A foreclosure tied to this type of loan can slash your credit score by 100 points or more and stay on your credit report for seven years, potentially impacting your ability to secure a mortgage, car loan, or even a job.

If a loan goes unpaid for 90 days, lenders may escalate the situation by taking legal action. To avoid this, reach out to the developer or lender as soon as possible to discuss payment plans or options like a deed in lieu of foreclosure. Taking action quickly can make a significant difference.

"Foreclosure is an unappealing option for both sides – it hurts your credit, and it costs the lender or resort time and money – so you might be able to work out an agreement." – Amy Loftsgordon, Attorney

Having the right legal support can be a game-changer. Firms like Aaronson Law Firm offer free consultations to help you understand your options, including the possibility of canceling your contract. Their attorneys can stop harassing calls from developers, protect your credit under federal laws like the Fair Credit Reporting Act, and negotiate settlements on your behalf. If litigation becomes necessary, licensed attorneys are equipped to provide a robust legal defense while prioritizing your best interests.

Whether you’re thinking about co-signing or already dealing with a default, knowing your rights and seeking professional legal advice is essential. Acting now can help you avoid serious financial setbacks and safeguard your future.

FAQs

What happens to a co-signer if the primary borrower stops paying a timeshare loan?

If the primary borrower fails to repay a timeshare loan, the co-signer takes on full responsibility for the outstanding balance. This means the lender has the right to pursue the co-signer directly for payment. The fallout can include late fees, added interest, and a potential hit to the co-signer’s credit score if the delinquency is reported to credit bureaus.

In more extreme situations, unresolved debts could lead to legal actions like wage garnishment or property liens, especially if the timeshare goes into foreclosure. For this reason, it’s crucial for co-signers to fully grasp the financial and legal risks involved before committing to a timeshare loan.

What can a co-signer do to protect their credit if a timeshare loan goes into default?

If you’re a co-signer on a timeshare loan that’s at risk of default, there are a few steps you can take to protect your credit. First, do your best to stay current on payments to avoid any immediate damage to your credit score. If keeping up with payments isn’t an option, you might want to explore a legal exit or rescission of the timeshare agreement to free yourself from the financial obligation. Another option is to work with the lender to negotiate a settlement to resolve the debt.

Additionally, make it a priority to review your credit reports regularly for any errors tied to the default. If you spot inaccuracies, dispute them right away and keep thorough records of all interactions with both the lender and credit bureaus. Consulting with a legal professional can make the process smoother and help safeguard your financial health.

What can co-signers do to get out of a timeshare agreement if it goes into default?

Co-signers stuck with a defaulted timeshare loan have a few legal routes to explore if they’re looking to break free from the agreement. If the purchase was made recently, they might still be within the rescission period – a short timeframe (usually about 10 days after signing) where they can cancel the contract by submitting a written notice and any required paperwork. But once that window closes, other strategies come into play.

One common option is pursuing a negotiated cancellation or settlement with the developer. This approach could involve striking a deal to release the co-signer from future obligations, often in exchange for a one-time payment. If this negotiation doesn’t work out, the next step might involve legal action, such as seeking a court-ordered cancellation. This type of cancellation usually hinges on proving issues like misrepresentation or breaches of contract by the developer.

For co-signers dealing with serious financial strain, other solutions might include a loan modification, a deed release, or similar legal remedies. However, foreclosure is also a potential outcome, though it can severely damage credit and lead to additional financial fallout. A carefully planned legal strategy – such as those provided by firms like Aaronson Law Firm – can guide co-signers through these challenges and help them secure a clean break from their timeshare obligations.

Related Blog Posts

- Negotiating Timeshare Debt Settlements

- How Timeshare Payment Plans Affect Credit Scores

- Timeshare Owners’ Associations and Fee Regulations

- Study: Impact of Timeshare Debt on Credit Scores