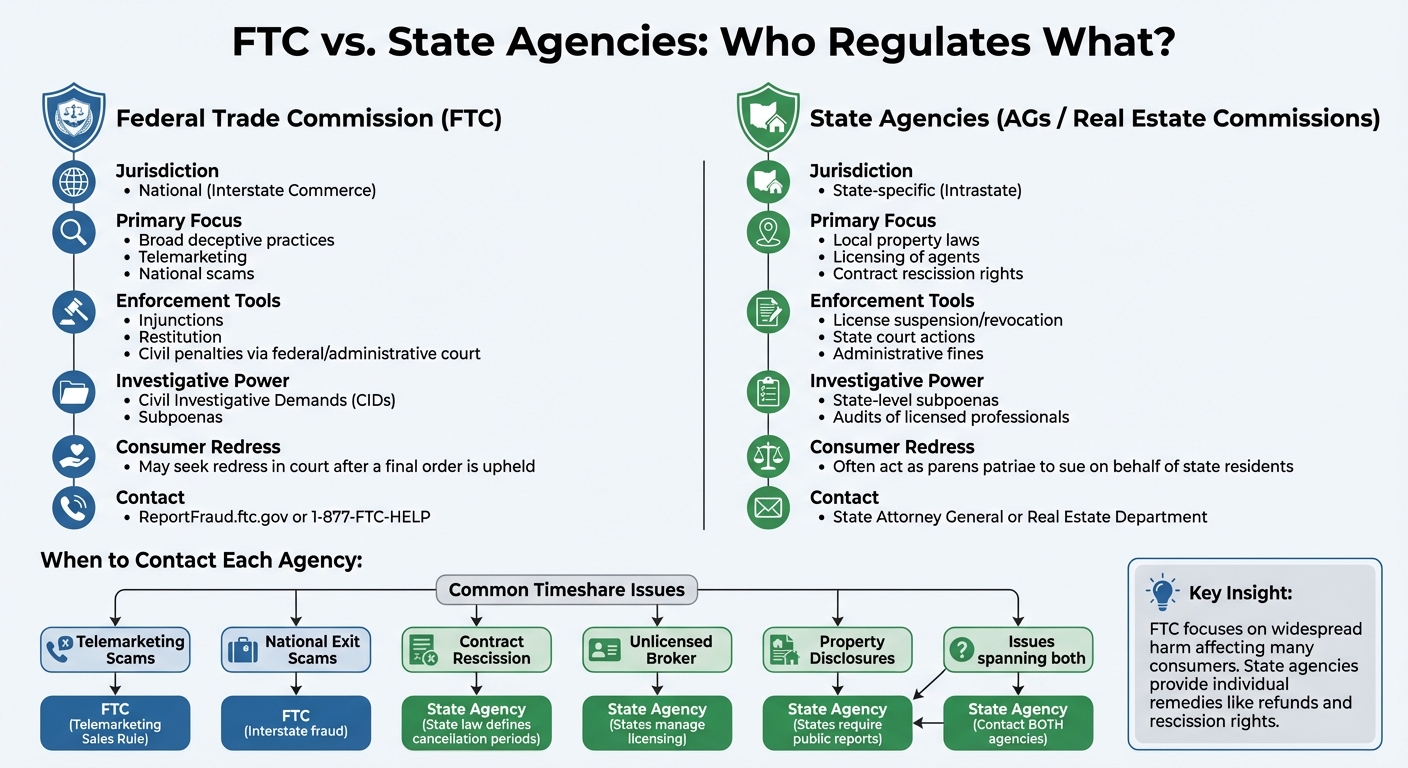

When it comes to timeshare issues, knowing whether to contact the Federal Trade Commission (FTC) or your state agency can save you time and headaches. Here’s the breakdown:

- FTC: Handles nationwide issues like telemarketing scams, deceptive practices, and large-scale fraud. They enforce federal laws and focus on widespread consumer harm.

- State Agencies: Oversee local real estate laws, contract rescission rights, and licensing of brokers. They address state-specific concerns like unlicensed brokers or property disclosures.

Key Differences:

- The FTC focuses on national scams and cannot resolve individual disputes.

- State agencies provide remedies like refunds, rescission rights, and penalties for violations within their jurisdiction.

Who to Contact:

- Telemarketing scams or national exit scams? File a complaint with the FTC at ReportFraud.ftc.gov.

- Contract rescission or unlicensed brokers? Contact your state Attorney General or real estate department.

Both agencies often collaborate, but understanding their roles ensures you get the right help. For complex cases, legal counsel specializing in timeshare disputes can guide you through state-specific laws and protect your rights.

The FTC’s Role in Timeshare Regulation

FTC’s Legal Authority and Enforcement Priorities

The Federal Trade Commission (FTC) operates under Section 5(a) of the FTC Act, which prohibits "unfair or deceptive acts or practices in or affecting commerce." This gives the FTC the power to go after companies that mislead consumers or cause harm that people can’t reasonably avoid.

Here’s how the FTC defines these practices: Deceptive practices involve false claims, omissions, or actions that could mislead a reasonable person. Unfair practices, on the other hand, are those that cause significant harm to consumers, which isn’t offset by any benefits and can’t be reasonably avoided. The agency enforces over 70 laws and uses tools like Civil Investigative Demands (CIDs) to gather evidence and testimony.

When violations are found, the FTC has several enforcement options. It can initiate administrative proceedings or seek court injunctions under Section 13(b) of the FTC Act. The agency can also pursue restitution for consumers under Section 19, which allows courts to order refunds when a company’s actions are deemed fraudulent or dishonest. Companies that violate final cease-and-desist orders may face civil penalties of up to $10,000 per violation.

The FTC also enforces the Telemarketing Sales Rule (TSR), targeting deceptive practices in telemarketing. Companies knowingly violating this rule can face civil penalties. With its broad authority, the FTC prioritizes tackling practices that cause the most harm to consumers, including widespread timeshare scams, as outlined below.

Common Timeshare Issues the FTC Regulates

The FTC focuses heavily on timeshare resale scams, where companies make false promises like claiming the resale market is booming, guaranteeing quick sales, or asserting that buyers are ready to purchase. These scams often involve upfront fees ranging from $800 to $3,400 – or even more – for services that are never delivered.

For example, in May 2013, the FTC took action against Resort Solution Trust Inc., a Florida-based company accused of deceiving thousands of consumers into paying upfront fees for resale services that were never provided. The U.S. District Court for the Middle District of Florida issued an order to stop the company’s operations and freeze its assets. Around the same time, the FTC and the Florida Attorney General jointly sued Vacation Communications Group LLC (operating as Universal Timeshare Sales Associates), which charged consumers between $1,600 and $2,200 based on false claims of having ready buyers. The court halted the company’s activities and appointed receivers to manage its operations.

The FTC also targets timeshare exit scams, where companies promise to cancel contracts but demand large upfront payments for services like legal help or advertising that never materialize. Additionally, the agency monitors high-pressure sales tactics, such as misleading “today only” offers, deceptive prize promotions, and failure to disclose cancellation rights. Charles A. Harwood, Acting Director of the FTC’s Bureau of Consumer Protection, highlighted the vulnerability of timeshare owners:

Con artists take advantage of timeshare owners who have been in tough financial straits and are desperate to sell their timeshares.

Another area of concern is vacation club misrepresentations, involving false claims about travel discounts, hidden fees, and the complexity of points-based systems. The FTC’s authority even extends to international scams if they harm U.S. consumers or involve significant domestic activity. In a major crackdown, the FTC announced 191 actions against fraudulent timeshare resale schemes, including three FTC cases and 83 civil actions filed by 28 states.

How to File Complaints with the FTC

Consumers can report issues to the FTC by visiting ReportFraud.ftc.gov or calling 1-877-FTC-HELP (1-877-382-4357). Assistance is available in both English and Spanish. These complaints are logged into Consumer Sentinel, a secure database accessed by over 2,000 law enforcement agencies.

While the FTC doesn’t resolve individual disputes, it uses consumer complaints to identify fraud patterns and launch large-scale investigations. Since 2015, the Consumer Sentinel Network has recorded about 7,000 complaints annually related to timeshare sales, with roughly 2,500 of those involving timeshare resales.

FTC enforcement actions can stop deceptive practices, freeze assets, and appoint receivers to manage companies. However, because FTC investigations are confidential, the agency typically doesn’t disclose their status unless the targeted company has made it public. Harwood offered this advice to timeshare owners:

Our message to timeshare owners is simple: never pay for a promise, get everything in writing first, and pay only after your unit is sold.

Next, we’ll explore how state agencies tackle similar challenges.

State Agencies’ Role in Timeshare Regulation

Key State Regulators and Their Laws

While the Federal Trade Commission (FTC) enforces nationwide rules, state agencies step in to address the unique needs of their local jurisdictions. These agencies oversee timeshare contracts and property regulations within their states, ensuring compliance with state-specific laws. For instance, Florida’s Department of Business and Professional Regulation (DBPR) handles timeshare operations through its Division of Condominiums, Timeshares, and Mobile Homes. In California, the Department of Real Estate (DRE) takes the lead, while New York’s Office of the Attorney General oversees timeshare offering plans via its Real Estate Finance Bureau.

Each state has its own set of laws governing timeshares. Florida’s Vacation Plan and Timesharing Act (Chapter 721) applies to plans involving more than seven use periods over at least three years. California’s Vacation Ownership and Time-share Act of 2004 requires developers to secure a public report from the DRE before marketing their properties. Similarly, New York law mandates that any timeshare offer mailed to a resident must reference a filed offering plan with the Attorney General’s office.

Timeshare Issues State Agencies Handle

State regulators are heavily involved in areas like project registration and public disclosures. For example, California law requires developers to provide a public report to prospective buyers before finalizing a sale. In New York, timeshare offers cannot be made to residents until an offering plan is officially filed.

States also enforce "cooling-off" periods, allowing buyers to cancel their contracts and receive a full refund within a specific timeframe. These rescission periods vary by state and are outlined in the table below.

Advertising and promotional activities are closely monitored as well. Laws in states like New York and Florida prohibit ads that mimic "urgent" or "official" notices. Promotions must clearly disclose the cash value of prizes and clarify that attending a sales presentation is required. Florida’s Timeshare Resale Accountability Act goes a step further by banning upfront fees for resale advertisers and requiring written agreements with clear disclosures. Violators can face penalties of up to $15,000 per violation.

Sales practices also fall under state scrutiny. For example, Florida’s DBPR oversees resort management and sales methods within the state. States like Florida and Washington require deposits from purchasers to be held in independent escrow accounts until construction is complete or the cancellation period expires. These regulations not only protect consumers but also provide them with direct avenues for filing complaints and seeking remedies.

Filing Complaints and Getting Remedies at the State Level

State agencies provide straightforward ways for consumers to file complaints. You can reach out to your state Attorney General’s office, consumer protection agencies, or real estate departments using online forms, hotlines, or direct submissions. The Missouri Attorney General emphasizes:

Use of any deception, fraud, false pretense, false promise, misrepresentation, unfair practice or concealment of fact by a person in connection with the sale of timeshares is subject to civil and criminal penalties that may be brought by the Attorney General.

Unlike the FTC, which focuses on large-scale enforcement actions, state agencies offer remedies tailored to individual consumers. These include rescission rights, restitution from state-regulated funds, and civil penalties. For example, Florida law requires resale advertisers to honor cancellation requests within seven days and issue refunds within 20 days.

To report scams, contact the Attorney General in the state where the timeshare property is located. If you wish to cancel a timeshare agreement, make sure to do so within the state-mandated rescission period. Use certified mail with a return receipt to document your timeline, and only work with licensed resale agents or brokers in the state where the timeshare is located.

For more guidance on navigating state-level regulations or canceling a timeshare contract, you can consult Aaronson Law Firm, which offers free consultations and specializes in timeshare cancellations.

| State | Primary Regulator | Key Statute | Rescission Period |

|---|---|---|---|

| Florida | DBPR (Division of FL Condominiums, Timeshares, and Mobile Homes) | Florida Vacation Plan and Timesharing Act (Ch. 721) | 10 days |

| California | Department of Real Estate (DRE) | Vacation Ownership and Time-share Act of 2004 | 7 days |

| New York | Office of the Attorney General | New York Offering Plan requirements | 7 business days |

| Washington | Director of Licensing | RCW 64.36 | 7 days |

| Missouri | Attorney General | Merchandising Practices Act (Chapter 407) | 5 days |

FTC vs. State Agencies: A Direct Comparison

FTC vs State Agencies: Timeshare Regulation Authority and Enforcement Comparison

Authority and Key Differences

The Federal Trade Commission (FTC) operates on a national scale, overseeing interstate commerce, while state agencies function within their respective borders, focusing on local real estate laws and consumer protection regulations. The FTC stands out as the only federal agency with jurisdiction over both consumer protection and competition across various industries. In contrast, state regulators zero in on matters specific to their state, such as timeshare-related issues.

When it comes to enforcement, the FTC uses tools like civil investigative demands, federal injunctions, and civil penalties. State agencies, on the other hand, rely on measures such as license revocations, state court actions, and administrative fines. A notable difference is that state consumer protection laws often allow private lawsuits, whereas the FTC Act does not permit individuals to file lawsuits under its provisions.

| Feature | Federal Trade Commission (FTC) | State Agencies (AGs / Real Estate Commissions) |

|---|---|---|

| Jurisdiction | National (Interstate Commerce) | State-specific (Intrastate) |

| Primary Focus | Broad deceptive practices, telemarketing, and national scams | Local property laws, licensing of agents, and contract rescission rights |

| Enforcement Tools | Injunctions, restitution, and civil penalties via federal/administrative court | License suspension/revocation, state court actions, and administrative fines |

| Investigative Power | Civil Investigative Demands (CIDs) and subpoenas | State-level subpoenas and audits of licensed professionals |

| Consumer Redress | May seek redress in court after a final order is upheld | Often act as parens patriae to sue on behalf of state residents |

Understanding these distinctions helps clarify which agency is better equipped to handle specific timeshare disputes.

Which Agency to Contact for Specific Problems

Deciding which agency to approach depends on the nature of your issue. For example, telemarketing scams and national exit scams typically fall under the FTC’s jurisdiction because they involve interstate commerce and violate the Telemarketing Sales Rule. On the other hand, if your concern involves an unlicensed broker or exercising your contract rescission rights, your state agency is the right contact. These matters are governed by state-specific laws, such as Arizona’s rule allowing cancellation by midnight on the 10th calendar day after signing a contract.

State agencies also handle issues like property disclosures and the public reports required before sales. For instance, California’s Department of Real Estate oversees these requirements. In cases where a problem spans both federal and state jurisdictions – like a resale scam involving deceptive telemarketing – it’s best to report the issue to both the FTC at ReportFraud.ftc.gov and your State Attorney General for a comprehensive approach.

| Issue Type | Primary Contact | Why? |

|---|---|---|

| Telemarketing Scams | FTC | Falls under the Telemarketing Sales Rule |

| Contract Rescission | State Agency | Cancellation periods are defined by state law |

| Unlicensed Broker | State Agency | States manage real estate licensing and standards |

| National Exit Scams | FTC | Often involves interstate fraud and deceptive advertising |

| Property Disclosures | State Agency | States require specific "Public Reports" for local sales |

Overlaps, Cooperation, and Enforcement Gaps

The FTC and state agencies often collaborate by sharing consumer complaint data and coordinating investigations to avoid redundancy. Federal agencies routinely consult with one another before initiating investigations, and state attorneys general can file federal antitrust lawsuits on behalf of their residents. Additionally, the FTC supports state legislatures and foreign competition agencies by sharing its expertise.

Despite this cooperation, gaps in enforcement remain. The FTC prioritizes cases that cause widespread harm, which can leave smaller, localized scams for state or local agencies to handle. Furthermore, most FTC investigations are confidential until official action is taken, leaving consumers unaware of ongoing efforts. State-specific variations in timeshare laws also create inconsistencies in consumer protection. When it comes to timeshares in foreign countries, U.S. regulatory influence is minimal. In such cases, the FTC advises using escrow accounts and hiring independent local agents to safeguard your interests.

If you’re facing these challenges or need assistance with canceling a timeshare contract, Aaronson Law Firm offers free consultations and specializes in timeshare-related legal matters. Up next, we’ll dive into strategies for managing complaints and finding legal support.

sbb-itb-d69ac80

How to Navigate Complaints and Legal Options

Choosing Between Federal and State Agencies

If you’re dealing with a national scam that crosses state lines, your first stop should be the FTC. You can file a complaint at ReportFraud.ftc.gov. For more localized issues, like rescission rights tied to state laws, contact your state attorney general. Understanding state-specific laws is key here. For instance, if you’re working with an unlicensed broker or need to verify a reseller’s credentials, the real estate licensing agency in the state where the timeshare property is located will be your go-to resource. The Federal Trade Commission (FTC) itself highlights this distinction:

The laws that govern timeshares are specific to the state where the property is located. – Federal Trade Commission

When your issue spans multiple jurisdictions, it’s a good idea to file complaints with both the FTC and your state agency. Additionally, research the company in question by checking records with your state attorney general and local consumer protection agencies in the reseller’s home state. This groundwork is often the first step toward resolving disputes and highlights why professional legal assistance can be so valuable.

How Legal Counsel Can Help with Timeshare Disputes

After pinpointing the correct regulatory agency, seeking advice from legal professionals can help safeguard your rights. Here’s why: under the FTC Act, you can’t sue directly as an individual. While the FTC may pursue consumer redress in certain cases, federal consumer protection laws don’t allow for private lawsuits. This means state-level legal actions and private representation are often your best bets for recovering damages.

Firms like Aaronson Law Firm offer services such as free consultations, legal demand letters, credit protection, and litigation support to help enforce your rescission rights. Timeshare attorneys can clarify your state’s rescission period, confirm whether resellers are properly licensed, and review complex public offering documents to ensure that all verbal promises are reflected in writing. Before investing in expensive third-party services, consult with dedicated legal experts who specialize in timeshare disputes.

Conclusion

Grasping the roles of the FTC and state agencies isn’t just about knowing who handles what – it’s about understanding how these roles impact your ability to seek help. Knowing which agency to turn to can make all the difference when navigating legal protections.

Here’s why this matters: your rights and remedies can vary widely depending on where you live. For example, rescission periods – the time you have to back out of a deal – aren’t the same in every state. If you’re dealing with an unlicensed reseller, state laws will be your main line of defense. On the other hand, if a scam affects multiple people, the FTC can step in with actions like injunctions or consumer redress. However, recovering your own losses often means turning to state-level laws or hiring private legal representation.

For more complex disputes beyond straightforward fraud, consulting a legal professional can be a game-changer. Legal counsel can help enforce your rescission rights, safeguard your finances, and guide you through state-specific statutes. While the FTC focuses on tackling practices that harm large groups of consumers, individual cases often require navigating state laws and contract terms. Many attorneys even offer free consultations to clarify your rights, draft demand letters, or negotiate formal agreements to protect your credit.

To handle your timeshare dispute effectively, take these steps: file complaints with both federal and state agencies, research state-specific regulations, and seek legal advice when standard solutions aren’t enough. By understanding these distinctions, you’ll be better equipped to protect your interests and resolve your dispute.

FAQs

Who should I contact for a timeshare issue: the FTC or my state agency?

Determining whether to reach out to the Federal Trade Commission (FTC) or your state consumer protection agency depends on the specifics of your situation.

If your issue involves nationwide scams or deceptive practices – like fraudulent telemarketing or misleading ads that impact consumers across multiple states – the FTC is the right choice. They tackle large-scale violations under federal laws such as the FTC Act and the Telemarketing Sales Rule.

On the other hand, for state-specific issues, like violations of your state’s rescission period (usually 3–15 days), undisclosed fees, or noncompliance with local disclosure regulations, your state attorney general or consumer protection office is better equipped to help. State laws often provide faster resolutions through local courts or administrative channels.

Here’s a quick guide:

- For federal-level fraud or multi-state scams: Contact the FTC.

- For state-specific violations or local disputes: Reach out to your state agency.

If you’re unsure where to start, consulting a timeshare-focused attorney might be a good idea. Firms like Aaronson Law Firm offer free consultations and have experience handling both federal and state-level timeshare issues.

What can the FTC do to address timeshare scams?

The FTC plays a crucial role in addressing deceptive timeshare practices. They have the power to investigate scams, file lawsuits, and issue court orders to halt illegal activities. Beyond that, they can secure refunds for victims, impose civil penalties, and, in urgent situations, freeze assets or issue temporary restraining orders.

These actions are designed to safeguard consumers from fraud while ensuring businesses are held accountable for breaking federal laws.

What is the state-mandated cancellation period for timeshare contracts?

The cancellation period, often called the rescission period, is the window of time legally provided for canceling a timeshare contract and getting a full refund. The length of this period depends on the state, typically falling between 3 and 15 days after you sign the contract or receive the required disclosure documents.

Here’s how it works in a few states:

- Florida: 10 days

- California: 7 days

- Texas: 6 days

Since every state has its own specific rules, it’s crucial to check the exact timeframe for the state where your timeshare is located. To cancel, you’ll generally need to send a written notice – using certified mail is a smart choice – within the allowed period. Acting promptly helps ensure you can rescind the contract without any issues.

Related Blog Posts

- Timeshare Fraud Prevention: Ultimate Guide

- FTC Role in Timeshare Regulation

- Timeshare Laws: Federal vs. State Protections

- How Consumer Protection Laws Impact Timeshare Complaints