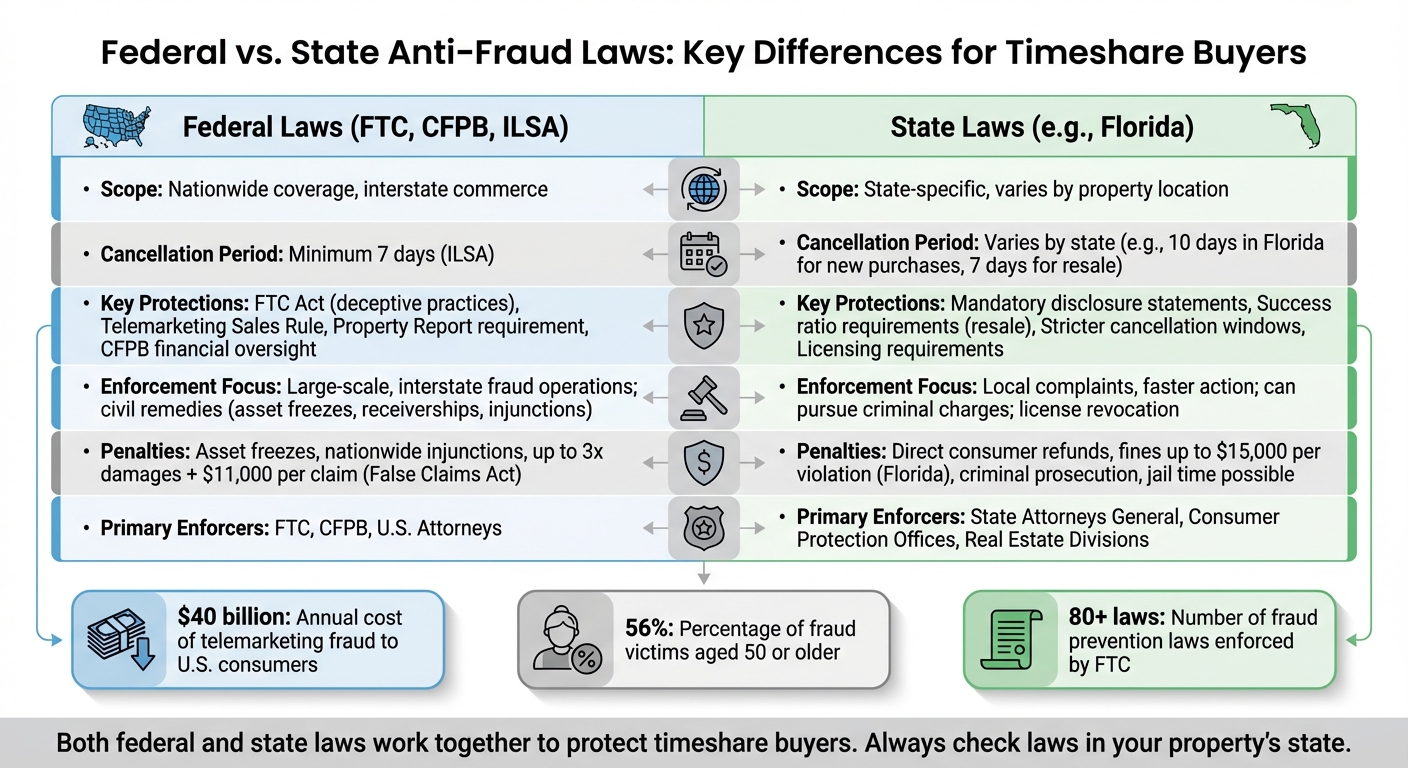

Federal and state laws work together to combat fraud in the timeshare industry, but they serve different purposes. Federal laws, like the FTC Act and Telemarketing Sales Rule, address nationwide issues like deceptive sales practices and telemarketing fraud, which cost U.S. consumers billions annually. Meanwhile, state laws focus on localized protections, such as cancellation periods and mandatory disclosures, tailored to the property’s location.

Key Points:

- Federal Protections: The FTC Act targets deceptive practices, while the Interstate Land Sales Full Disclosure Act (ILSA) ensures buyers get proper disclosures and a minimum 7-day cancellation window. Agencies like the CFPB also oversee financial aspects, such as misleading loan terms.

- State Protections: Laws vary by state but often provide stricter rules. For example, Florida enforces a 10-day cancellation window for new purchases and requires clear disclosures for resale agreements. Penalties for violations can include refunds and fines.

- Enforcement: Federal agencies focus on large-scale fraud, using tools like asset freezes. State Attorneys General handle local cases, often acting faster on consumer complaints.

Quick Comparison:

| Feature | Federal Laws (FTC, CFPB) | State Laws (e.g., Florida) |

|---|---|---|

| Scope | Nationwide | State-specific |

| Cancellation Period | Minimum 7 days (ILSA) | Varies (e.g., 10 days in Florida) |

| Enforcement Focus | Large-scale fraud | Local complaints, faster action |

| Penalties | Asset freezes, injunctions | Refunds, fines, criminal charges |

Understanding both federal and state protections is crucial for timeshare buyers facing fraud or seeking to cancel contracts. Always check the laws in the state where the property is located and consult legal experts for guidance.

Federal vs State Anti-Fraud Laws for Timeshare Buyers Comparison Chart

Federal Anti-Fraud Laws: Protections and Scope

Federal laws offer nationwide safeguards for timeshare buyers, addressing the challenges posed by fraudsters who often operate across state lines. State laws alone can’t tackle this issue effectively, which is why federal agencies like the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) play a critical role. Their protections follow consumers no matter where they live.

Telemarketing fraud costs U.S. consumers an estimated $40 billion annually, with timeshare schemes being a significant contributor. Alarmingly, about 56% of individuals on confiscated "mooch lists" – used by scammers to target victims – are aged 50 or older, underscoring the vulnerability of older adults to high-pressure tactics.

Below, we break down the key federal statutes that combat timeshare fraud and their specific functions.

The Federal Trade Commission Act (FTC Act) and Telemarketing Sales Rule

The FTC Act is the cornerstone of federal efforts to combat timeshare fraud. It empowers the FTC to address "unfair or deceptive acts or practices" in commerce and seek monetary compensation for consumers harmed by fraudulent activities. The FTC enforces this Act alongside more than 80 other laws aimed at preventing fraud and deception.

The Telemarketing Sales Rule (TSR) provides additional protections for consumers. It sets strict guidelines for how telemarketers, including timeshare companies, must operate. For example:

- Telemarketers must clearly state upfront that the call is a sales pitch.

- They must identify the seller and provide accurate details about the product or service being offered.

- Coercive or harassing call patterns are prohibited, and telemarketers can only call during specific hours.

These rules are designed to address common scams, such as high-pressure sales tactics, misleading resale promises, and false claims of guaranteed returns. When companies violate these rules, the FTC can take enforcement actions, which may include securing refunds for victims.

Beyond telemarketing, federal laws also regulate property sale disclosures, especially for timeshares sold across state lines.

The Interstate Land Sales Full Disclosure Act (ILSA)

The Interstate Land Sales Full Disclosure Act (ILSA) focuses on timeshare sales involving undeveloped properties, particularly those marketed across state borders. Under this law, developers are required to provide a Property Report before buyers sign a contract. This report must include essential details about the property, amenities, and any planned facilities.

One of ILSA’s key protections is the seven-day cooling-off period, which allows buyers to cancel their contract until midnight on the seventh day after signing. If a state law offers a longer cancellation period, that extended timeframe takes precedence, ensuring buyers receive the most favorable terms available.

ILSA also prohibits misleading claims. For example:

- Developers cannot advertise a timeshare as a "good investment" unless they can provide written proof of similar properties being resold at a profit.

- They cannot label lots as "buildable" unless they have access to potable water, sewage systems, and legal entry.

- All marketing materials must include a federal disclaimer: "Obtain the Property Report required by Federal law and read it before signing anything. No Federal agency has judged the merits or value, if any, of this property."

These requirements, combined with telemarketing regulations, create a framework designed to protect buyers from deceptive practices. The CFPB adds another layer of oversight, particularly in financial transactions.

Consumer Financial Protection Bureau (CFPB) Enforcement

The CFPB enforces federal laws related to financial products and services, including timeshare financing. It investigates unfair, deceptive, or abusive acts or practices (UDAAPs) that may occur during financial transactions, such as misleading loan terms or hidden financing costs.

The CFPB also enforces ILSA regulations, known as Regulation K, giving it authority to act against developers who fail to meet federal disclosure standards. This dual enforcement – shared with the FTC – ensures that fraudulent timeshare operators can be held accountable from multiple angles.

When violations occur, the CFPB has the power to:

- Order refunds for affected consumers.

- Impose civil penalties on companies.

- Mandate changes to deceptive business practices.

This is particularly critical in cases of financing abuses, where buyers may find themselves trapped in loans they didn’t fully understand or were misled into accepting. Together, the FTC and CFPB provide a robust safety net for protecting consumers from timeshare fraud.

State Anti-Fraud Laws: Local Protections and Differences

Federal laws may offer a broad layer of protection, but state laws often step in to address issues unique to specific regions. States like Florida, Colorado, and Arizona have implemented anti-fraud statutes that go beyond federal standards, tackling local concerns such as deceptive resale practices and misleading advertising. These state-level measures allow attorneys general to respond swiftly to local complaints, often delivering faster results than federal investigations, which typically focus on larger, nationwide fraud cases. By honing in on local market challenges, these laws work alongside federal protections to provide a more comprehensive safety net.

State laws often specify cancellation periods, require clear disclosures, and enforce penalties for violations. These measures give timeshare buyers more straightforward options for addressing fraud.

Florida’s FDUTPA and the Timeshare Resale Accountability Act

Florida has some of the strongest protections for timeshare buyers. The state’s Deceptive and Unfair Trade Practices Act (FDUTPA) is the cornerstone of its anti-fraud enforcement, working hand-in-hand with Chapter 721 (Vacation and Timeshare Plans) and the Timeshare Resale Accountability Act.

The Timeshare Resale Accountability Act focuses on the resale market, requiring service providers to disclose a written "success ratio" before collecting any fees. This ratio compares the number of listings to actual sales over the past two calendar years, giving consumers a clearer sense of their chances.

Florida takes disclosure rules seriously. The success ratio statement must be prominently displayed in bold, 12-point font or larger, and placed directly above the signature line. If this disclosure is missing, the contract becomes automatically void, allowing the consumer to claim a full refund.

"A company who violates these provisions has committed a violation of the Unfair and Deceptive Trade Practices Act with a penalty not to exceed $15,000 per violation." – Florida Attorney General’s Office

Florida also provides clear timelines for cancellations and refunds. Buyers have a 10-day cooling-off period for new timeshare purchases and a 7-day cancellation period for resale advertising agreements. Refunds must be processed within 20 days of receiving a valid cancellation notice.

Additionally, Florida enforces strict telemarketing rules. Telemarketers must identify themselves and their company within the first 30 seconds of a call and provide their state-issued license number along with a physical street address.

| Protection Feature | Florida New Purchase (Ch. 721) | Florida Resale (Resale Accountability Act) |

|---|---|---|

| Cancellation Period | 10 Days | 7 Days |

| Refund Deadline | 20 Days from notice | 20 Days from notice |

| Mandatory Disclosure | Public Offering Statement | Success Ratio (Past 2 Years) |

| Penalty for Violation | Varies by section | Up to $15,000 per violation |

Enforcement of these regulations falls to the Florida Attorney General’s Office and the DBPR (Division of Florida Land Sales). Consumers can report violations by contacting the fraud hotline at 1-866-9-NO-SCAM or filing complaints directly with the DBPR.

Colorado and Arizona Consumer Protection Laws

Florida isn’t the only state taking a strong stance against timeshare fraud. Colorado and Arizona have also implemented measures tailored to their markets.

In Colorado, the Consumer Protection Act prohibits deceptive practices in both primary and resale timeshare transactions. This includes cracking down on misleading advertising and false claims about investment returns. The Colorado Attorney General has the authority to investigate and prosecute offenders.

Arizona places a strong focus on disclosure and licensing. Timeshare developers must register with the Arizona Department of Real Estate and keep detailed transaction records. The state also enforces specific cancellation rights, though the timelines and procedures differ from Florida’s.

Both states allow consumers to take private legal action against fraudulent operators. This gives buyers a quicker path to remedies like damages, contract cancellations, and attorney’s fees compared to federal processes.

Federal vs. State Anti-Fraud Laws: Main Differences

Scope: Nationwide vs. State-Specific Protections

Federal laws have a broad reach, applying across the entire country. For instance, the FTC Act addresses deceptive practices in interstate commerce, making it effective for fraud schemes that cross state lines or involve national marketing efforts. This is especially relevant for scams that use telemarketing or the internet to target consumers all over the U.S.

State laws, on the other hand, are designed with local concerns in mind. Take timeshare contracts, for example – rules about cancellation rights, disclosure requirements, and licensing standards are tied to the state where the property is located. Some states, like Oregon, grant buyers a short window to cancel, but the length of this period can vary widely. Because these protections differ so much between states, it’s crucial for buyers to understand the specific laws where their transaction takes place. These differences also shape how fraud cases are handled by authorities.

Enforcement: Federal Agencies vs. State Attorneys General

Federal agencies, such as the FTC and CFPB, focus on tackling large-scale, interstate fraud. They use civil remedies like freezing assets, appointing receivers, and obtaining injunctions. For example, in May 2013, the FTC and Florida Attorney General jointly sued Vacation Communications Group, a fraudulent operation targeting consumers with false claims and charging $1,600 to $2,200. The court froze U.S. assets and placed the company into receivership.

State Attorneys General, however, handle local consumer protection laws and can act quickly on region-specific complaints. They also have the authority to pursue criminal charges against individual scammers, which federal agencies rarely do. In one coordinated effort against timeshare fraud, law enforcement initiated 191 actions, including 3 FTC cases, 83 civil actions by 28 states, and over 184 criminal prosecutions.

| Feature | Federal Enforcement | State Enforcement |

|---|---|---|

| Jurisdiction | Nationwide / Interstate Commerce | State-specific / Intrastate |

| Primary Enforcers | FTC, CFPB, U.S. Attorneys | State Attorneys General, Consumer Protection Offices |

| Common Remedies | Asset freezes, receiverships, nationwide injunctions | Rescission enforcement, license revocation, criminal prosecution |

| Limitations | Focus on large-scale, high-impact cases | Constrained by state borders; varies by local laws |

Although federal and state enforcement approaches differ, their methods of penalizing fraud and providing remedies for victims highlight even greater distinctions.

Penalties and Remedies for Fraud Victims

Federal laws aim to stop systemic fraud rather than compensate individual victims. Agencies like the FTC and CFPB focus on halting widespread deceptive practices. For instance, under the False Claims Act, violators can face fines of up to three times the loss, plus $11,000 per claim.

State-level remedies often provide more direct relief to victims. In 2016, the Arizona Attorney General’s Office reached a settlement with Diamond Resorts, securing $650,000 in restitution for consumers and allowing hundreds of buyers to cancel misleading timeshare contracts. This saved consumers an estimated $25 million in future maintenance fees. Nevada law offers additional protection by requiring resellers to hold 80% of advance fees in escrow, ensuring buyers have a safety net if a sale falls through. Some states, like Georgia, even treat timeshare law violations as criminal offenses, with penalties that can include jail time – something federal civil actions don’t allow.

State administrative bodies also play a role. For example, Florida’s Timeshares Division can fine, place on probation, or revoke licenses of violators. Between April 2014 and April 2016, the division received 2,360 complaints but acted on fewer than 5%, highlighting the need for private legal action in many cases.

sbb-itb-d69ac80

How Timeshare Buyers Can Use Anti-Fraud Laws

Using Anti-Fraud Protections to Cancel Timeshare Contracts

If you’ve been misled during a timeshare purchase, there are legal avenues to explore. The first and most straightforward option is the cancellation window, which typically lasts between 7 and 15 days, depending on state law. Federal Regulation K guarantees a minimum 7-day period to revoke your contract, but if your state allows more time, the longer period applies. During this window, you can cancel your contract for any reason – no need to prove fraud.

Once the cancellation period ends, buyers may still have options if required disclosures weren’t provided. For instance, federal law mandates that developers must give you a Property Report before you sign the contract. States often have their own disclosure requirements, like Florida’s public offering statement. If these documents were missing, included inaccuracies, or were provided after signing, you might have grounds to void the agreement. Additionally, if a salesperson made unsupported claims – such as promises of increased resale value – this could constitute a violation of federal law.

To strengthen your case, keep all contracts, marketing materials, and detailed notes from sales presentations. If your contract includes an arbitration clause, consulting an attorney can help you determine whether it’s enforceable or if litigation is an option.

It’s also important to know that under the FDCPA (Fair Debt Collection Practices Act), hiring an attorney means debt collectors must stop contacting you directly. However, attempting to cancel your contract or stop payments without legal guidance can lead to foreclosure, breach of contract lawsuits, or credit damage. Legal representation ensures these protections are properly utilized.

How Aaronson Law Firm Can Help

Aaronson Law Firm specializes in canceling timeshare contracts by leveraging both federal and state anti-fraud laws. They begin with a free consultation to evaluate your case, determining if your contract violates disclosure requirements, includes deceptive claims, or was the result of high-pressure sales tactics.

The firm drafts demand letters challenging the validity of your contract. Common issues they address include missing required documentation, improper handling of escrow funds, or false claims about resale value. These actions often rely on laws like Florida’s FDUTPA (Florida Deceptive and Unfair Trade Practices Act) or the federal FTC Act to support cancellation efforts.

Beyond contract cancellation, Aaronson Law Firm also provides credit protection under the FDCPA and offers litigation support. Their approach draws from real-world successes, such as the December 2016 Arizona Attorney General settlement with Diamond Resorts. That case resulted in $650,000 in restitution and allowed hundreds of consumers to cancel their contracts, avoiding an estimated $25 million in future maintenance fees.

Conclusion

Federal and state anti-fraud laws work hand in hand to create a strong safety net for timeshare buyers. Federal laws like the FTC Act and the Telemarketing Sales Rule set nationwide standards for how timeshares are marketed and sold. At the same time, state laws address specific requirements for real estate contracts, including disclosure rules and cancellation periods. Together, these layers of protection uphold consumer rights throughout the entire timeshare transaction process. This dual approach ensures fraudsters face enforcement from multiple directions – whether it’s the FTC addressing deceptive practices or State Attorneys General pursuing violations of local consumer protection laws.

When federal and state authorities collaborate, the results can be powerful. Past joint actions have shut down fraudulent operations and frozen assets, showcasing the strength of coordinated enforcement.

"Law enforcement agencies at every level of government are working together to put an end to this problem." – Charles A. Harwood, Acting Director of the FTC’s Bureau of Consumer Protection

This overlapping system gives buyers multiple layers of protection against fraudulent practices.

If you’re dealing with a fraudulent timeshare contract, seeking expert legal advice is crucial. Timeshare laws differ greatly from state to state, often involving complex jurisdictional issues. Acting quickly is key – delaying cancellation could lead to foreclosure, lawsuits, or credit damage. A knowledgeable attorney can pinpoint violations in your contract, navigate federal and state protections, and ensure debt collectors comply with FDCPA rules, stopping direct contact with you.

If you suspect fraud in your timeshare purchase, document everything and consult with a specialized attorney right away. Aaronson Law Firm offers free consultations to help determine if your contract violates federal or state laws, giving you the best chance for a successful cancellation.

FAQs

What are the key differences between federal and state anti-fraud laws for timeshares?

Federal and state anti-fraud laws for timeshares differ in their reach and specificity. Federal laws, like those overseen by the Federal Trade Commission (FTC), tackle fraud and deceptive practices that cross state lines. These protections are designed to shield consumers from issues such as misleading advertising, scams in the resale market, and unethical sales tactics on a national scale. A notable example is the Interstate Land Sales Act (ILSA), which enforces transparency in certain sales processes.

State laws, however, zero in on the finer details of timeshare transactions within their borders. They regulate areas like contract terms, rescission periods (which can vary from 3 to 15 days), and required disclosures related to fees, property specifics, and usage rights. These localized rules ensure buyers are well-informed about their rights and obligations under the laws of that particular state.

Federal laws provide a broad safety net against fraud nationwide, while state laws handle the more detailed aspects of timeshare agreements to protect consumers locally.

How do state laws affect my ability to cancel a timeshare contract?

State laws have a big say in how and when you can cancel a timeshare contract. One key factor is the rescission period – the short window of time when you’re legally allowed to back out of the contract and potentially get a full refund. This period isn’t the same everywhere; it can range from just 3 days to as long as 15 days, depending on the state.

Beyond the rescission period, states often have specific rules about how cancellations should be handled. This might include the type of paperwork you need to submit or the proper way to notify the developer. Some states even add extra layers of protection for consumers, like requiring certain disclosures or offering cooling-off periods. These details can vary a lot, so it’s important to know the rules in your state to make sure you act within your rights and don’t miss your chance to cancel that timeshare.

How do federal agencies like the FTC and CFPB protect consumers in timeshare transactions?

Federal agencies like the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) are key players in protecting consumers from fraud and deceptive practices in the timeshare industry.

The FTC focuses on enforcing laws that prevent scams, such as misleading timeshare resale offers or fake travel prize schemes. It also ensures that buyers are provided with clear and accurate information about costs, rights, and obligations before committing to a timeshare agreement.

Meanwhile, the CFPB oversees financial practices tied to timeshares, working to ensure fairness and transparency in lending and payment terms. Together, these agencies investigate fraudulent activities, enforce regulations, and promote transparency to help protect consumers in timeshare transactions.

Related Blog Posts

- How Courts Handle Deceptive Timeshare Sales

- Timeshare Laws: Federal vs. State Protections

- How Consumer Protection Laws Impact Timeshare Complaints

- FTC vs. State Agencies: Who Regulates What?