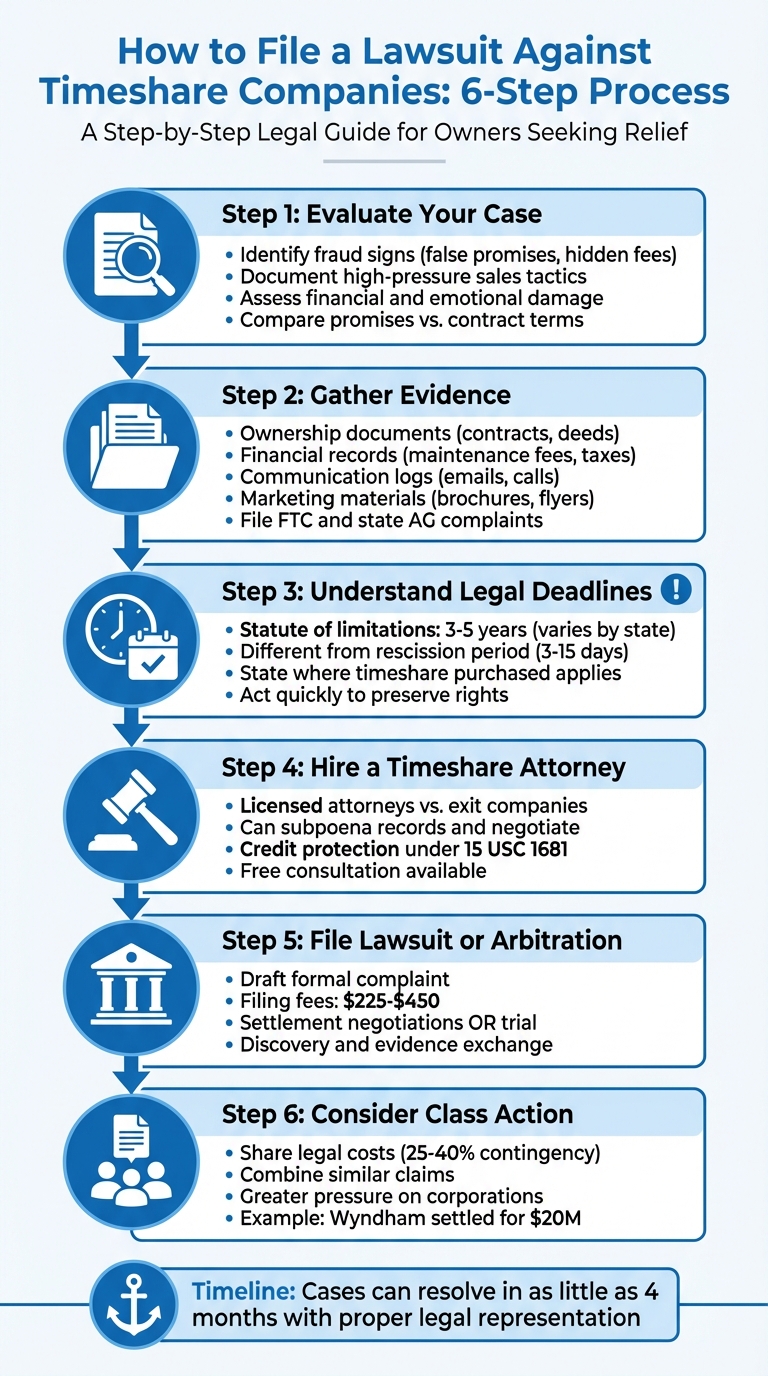

If you’re stuck in a timeshare contract that feels unfair or fraudulent, you’re not alone. Many people face misleading sales tactics, hidden fees, or false promises from timeshare companies. Filing a lawsuit might be your way out, but it requires preparation and legal expertise. Here’s a quick breakdown of what you need to know:

- Identify Fraud: Look for signs like false promises, undisclosed fees, or pressure tactics during the sales process.

- Gather Evidence: Collect contracts, financial records, communication logs, and promotional materials.

- Know Deadlines: Statutes of limitations (usually 3–5 years) vary by state, so act quickly.

- Hire an Attorney: A licensed attorney can handle lawsuits, protect your credit, and negotiate on your behalf.

- Consider Class Actions: If others have experienced similar issues, joining a class action lawsuit might be an option.

Taking legal action isn’t just about canceling your contract – it’s about holding companies accountable for deceptive practices. Whether you pursue an individual lawsuit or join a class action, having the right legal support is key to reclaiming your financial freedom.

6-Step Process to File a Lawsuit Against Timeshare Companies

Step 1: Evaluate Your Case and Identify Timeshare Fraud

Before diving into legal action, it’s essential to determine whether you have a valid claim. Not every case of buyer’s remorse qualifies as fraud – but if you were misled or pressured into signing, you may have a strong case. The goal is to pinpoint specific deceptive practices that violate consumer protection laws. Recognizing these tactics is the first step in building your case.

Common Signs of Fraud

Start by comparing what the sales representative promised during their pitch to what’s actually written in your contract. One of the most frequent forms of timeshare fraud involves false or misleading contract terms. For instance, if the salesperson emphasized strong resale value or guaranteed rental income, but these promises are absent from your agreement, that’s a major warning sign. Similarly, claims of easy booking access that never materialize could point to misrepresentation.

Another red flag is the presence of undisclosed or hidden fees. Many buyers are blindsided by escalating maintenance fees, unexpected property taxes, or special assessments that were never mentioned in the sales presentation. If your contract includes a perpetuity clause – binding you (or even your heirs) to financial obligations indefinitely – and this wasn’t clearly explained, you might have been misled.

"Timeshare owners have a right not to be defrauded by false or misleading statements about the nature of a timeshare purchase, and a right to obtain court-ordered rescission of timeshare contracts that are unlawful, oppressive, unconscionable and unfair." – Coalition to Reform Timeshare

High-pressure sales tactics are another common issue. If you endured hours-long presentations, were pressured to sign on the spot with claims like "this deal is only available today", or faced multiple salespeople trying to wear you down, these tactics may constitute fraud. According to the Federal Trade Commission (FTC), such aggressive sales methods have become a growing problem in the multi-billion dollar timeshare industry.

Additionally, watch for rescission obstruction – efforts by the company to block your right to cancel. If they ignored your cancellation request, made the process confusing, or failed to inform you about the state-mandated cooling-off period, this could be a serious violation. In November 2022, the FTC took action against a company that charged customers between $5,000 and $80,000 for fraudulent timeshare exit services, often targeting older individuals with high-pressure tactics and delivering little to no results.

Assess Financial and Emotional Damage

Once you’ve identified fraudulent practices, take stock of the financial and emotional toll to strengthen your claim. Start by documenting all your costs: the purchase price, interest, maintenance fees, property taxes, and any special assessments. Track annual fee increases to highlight the growing financial burden that may not have been disclosed upfront.

If promises about amenities, services, or access weren’t kept, document those breaches of contract. For example, if you were assured easy booking at premium destinations but consistently can’t reserve the dates or locations you want, that’s a clear violation.

Don’t overlook the emotional distress caused by the situation. The stress of unexpected debt, aggressive collection calls, or feeling trapped in a contract you no longer want can have a serious impact. While harder to measure than financial losses, this psychological harm adds weight to your case – especially when supported by evidence of deceptive practices.

To build a strong case, gather all relevant communications. Keep records of dates, times, representative names, and details of what was promised versus what was delivered. Shift verbal conversations to written correspondence to create a clear paper trail. This documentation will be crucial when presenting your case to an attorney or in court.

Step 2: Gather Evidence to Support Your Case

Once you’ve pinpointed fraudulent practices, it’s time to build a solid evidence file. This is the backbone of your case. Strong lawsuits depend on hard evidence – not just your personal account versus the company’s claims. Your goal? To create a clear, undeniable record of what was promised, what you paid, and how the timeshare company failed to meet its obligations.

Collect All Documentation

Start with your ownership documents: the purchase contract, deed, closing documents, and any amendments. These establish the terms of your agreement and can highlight any inconsistencies or breaches.

Next, organize all financial records by year. Include maintenance fee statements, property tax notices, assessment letters, and any records of unexpected surcharges or penalties. Tracking these costs over time can reveal fee increases that weren’t disclosed during the sales process, especially if those increases outpace inflation.

Don’t overlook communication logs. These are often underestimated but can be crucial. Keep a detailed record of every interaction with the resort, noting the date, time, names and departments of representatives, discussion summaries, and any reference or case numbers. As the ACA Group points out, "A well-documented track record of your experience can strengthen your case and support potential next steps." Make it a habit to log calls immediately after they happen.

Save copies of all written correspondence, including emails, letters, and responses from the resort. For important documents like rescission letters or formal disputes, send them via certified mail with a return receipt. This ensures you have proof that the company received your communication.

Also, hold on to promotional and sales materials that initially drew you in. This includes raffle entries, flyers, text messages, emails, brochures, or any handouts from the sales presentation. These materials can demonstrate misleading marketing tactics, especially if they advertised benefits that were never included in your contract.

The FTC advises, "You have the right to get all promises in writing." If sales reps made verbal commitments about resale value, rental income, or booking availability, insist on written confirmation. If they refuse or the written terms differ from what was promised, those discrepancies can serve as powerful evidence of fraud.

| Document Category | Items | Purpose in a Lawsuit |

|---|---|---|

| Ownership | Purchase Contract, Deed, Public Offering Statement | Defines legal terms and obligations |

| Financial | Maintenance Fee Statements, Tax Notices, Payment Records | Highlights financial harm and fee increases |

| Communication | Email threads, Certified Mail receipts, Phone logs | Shows attempts to resolve the issue |

| Marketing | Flyers, prize vouchers, ads | Reveals deceptive or high-pressure tactics |

| Regulatory | FTC/AG Complaint confirmations | Proves escalation to authorities |

File Complaints with Regulatory Agencies

Filing complaints with regulatory agencies is a critical step. It not only creates an official record but also shows that you’ve made efforts to resolve the issue before pursuing litigation. These agencies rely on consumer reports to identify patterns of fraud and take action against companies violating consumer protection laws.

Start by reporting the fraud to the FTC at ReportFraud.ftc.gov. The FTC uses these reports to build cases against fraudulent businesses.

Then, file a complaint with the state attorney general in the state where the timeshare resort operates. Since timeshare laws vary by state, the attorney general’s office has jurisdiction over companies within its borders. If you own a deeded timeshare, also contact the Real Estate Commission in that state.

Keep all confirmation receipts or reference numbers from your complaints. These records demonstrate that you’ve escalated the matter to the proper authorities. It shows you’re not just dissatisfied but a victim of practices serious enough to warrant formal complaints – an important detail when presenting your case to an attorney.

Step 3: Understand Legal Deadlines and Statutes of Limitations

Knowing the statute of limitations – the maximum time you have to file a lawsuit – is critical. If you miss this deadline, your case will be dismissed.

"It’s a race against the clock to litigate against the resorts, as a case can be dismissed if the Statute has passed the designated deadline." – The Abrams Firm

While gathering evidence is essential, understanding these legal deadlines is just as important. Keep in mind that this deadline is entirely separate from the rescission period, which is the 3- to 15-day window allowing you to cancel your contract penalty-free. Even if you’ve missed the rescission window, you may still have the option to file a lawsuit for fraud or breach of contract.

State-Specific Time Limits Matter

Statutes of limitations vary widely depending on the state, and the clock usually starts ticking either when you signed the contract or when the fraud was discovered. Typically, you’ll have 3 to 5 years to file a lawsuit related to your timeshare. For instance, in Arkansas, you have up to 4 years to challenge the validity of a contract or the accuracy of a public offering statement.

The key here is that the laws of the state where the timeshare was purchased apply, not the laws of your home state. In states with a high volume of timeshare purchases – like Florida, Nevada, South Carolina, and California – you’ll often find more specific statutes governing timeshares. Other states might rely on broader property or consumer protection laws, which can influence your filing deadline. These time limits are designed to shield consumers from prolonged fraudulent practices.

In some situations, the Discovery Rule might extend your filing window. This rule allows you to file after the standard deadline if you can prove the fraud wasn’t immediately noticeable. However, this exception is complex, varies by state, and requires expert legal advice.

Why Acting Quickly Is Crucial

Time is not on your side when it comes to legal deadlines. Timeshare companies often use stalling tactics, such as vague promises or misleading communication, to delay your actions. Waiting too long can jeopardize your legal rights, lead to aggressive collection efforts, and severely harm your credit. For example, a timeshare foreclosure can remain on your credit report for 7 years.

To protect your rights, consult a specialized timeshare attorney as soon as you suspect fraud or a breach of contract. Acting promptly ensures you preserve evidence, secure witness testimony, and avoid running up against the statute of limitations. Don’t wait until the 3-year mark or beyond – it may already be too late to build a strong case.

Step 4: Hire a Timeshare Attorney

Once you’ve gathered your evidence and are mindful of legal deadlines, the next critical step is to bring in a licensed timeshare attorney. This is a much better choice than relying on unlicensed exit companies, as attorneys offer the expertise and legal authority required to handle these cases effectively.

Why Legal Expertise Matters

A skilled attorney brings a host of advantages to the table. They can subpoena records to uncover contract violations, draft formal legal letters, negotiate settlements, and even issue credit protection letters under 15 USC 1681 to safeguard your credit score. Most importantly, licensed attorneys are bound by law to act in your best interest and can represent you in court or arbitration if necessary. This level of expertise is essential to challenge deceptive practices and assert your legal rights confidently.

What Aaronson Law Firm Offers

Aaronson Law Firm specializes exclusively in timeshare cancellations, with over 20 years of experience in this field. They start with a free consultation to understand your case and develop a tailored legal strategy. From there, they gather all required documents and issue credit protection letters to prevent any negative impact on your credit.

Their litigation support has delivered impressive results. For example, one client had their contract canceled in just four months, while another case led to $25,000 in compensation. These outcomes highlight the firm’s ability to provide the legal tools and strategies needed to handle timeshare fraud effectively, aligning with the broader steps outlined earlier in this process.

sbb-itb-d69ac80

Step 5: File Your Lawsuit or Arbitration Demand

Once you’ve gathered all your evidence and hired an attorney, it’s time to officially start your legal action. This involves filing a formal complaint or, if required by your contract, an arbitration demand.

Draft and Submit the Complaint

Your attorney will prepare a detailed complaint outlining your legal claims against the timeshare company. These claims often include fraud, misrepresentation, or breach of contract. The complaint must also clearly identify the defendant, which is often a limited liability company or corporation. Your attorney will ensure the correct agent for service of process is named.

In addition to the complaint, your attorney will file a Summons and Civil Case Cover Sheet with the court clerk. Filing fees typically range from $225 to $450, though fee waivers may be available depending on your circumstances.

If your timeshare contract includes an arbitration clause, your attorney will file an arbitration demand instead of a court complaint. As Aaronson Law Firm explains, "To challenge the validity of an ostensibly binding contract is decidedly a job that can only be handled by licensed professionals."

Once the complaint or arbitration demand is submitted, your case moves into the next phase.

Settlement or Trial Options

After filing, your case may proceed in one of two directions: settlement negotiations or trial. In most cases, parties engage in settlement discussions, where your attorney works with the timeshare company to resolve the dispute without going to trial. Settlements are often faster and less stressful. For instance, Wyndham Vacation Resorts settled a class action lawsuit for $20 million after being accused of false advertising and misleading sales practices.

If a settlement cannot be reached, the case may proceed to trial or a final arbitration hearing. During the trial phase, both sides exchange evidence in a process called discovery. Your attorney might request the judge to make preliminary rulings or require the timeshare company to provide specific documents. Civil lawsuits can take over a year to resolve and may result in outcomes such as formal cancellation of the contract, refunds, or the elimination of future financial obligations like maintenance fees.

Step 6: Consider Class Action Lawsuit Options

When taking on large corporations with extensive resources, individual lawsuits can feel like an uphill battle. That’s where class action lawsuits come in. If a group of timeshare owners has experienced similar deceptive practices, a class action allows their claims to be combined into one unified legal case. This approach not only spreads out the costs but also increases the collective pressure on the company being sued.

Why Class Action Lawsuits Make Sense

Class actions provide a practical way to challenge large timeshare corporations, especially when the cost of an individual lawsuit might outweigh the potential recovery. By pooling resources, plaintiffs share legal expenses, which are often handled on a contingency basis – typically 25–40% of any settlement. This arrangement makes it possible to take on even the most well-funded corporations without bearing the financial burden alone.

Beyond affordability, a class action amplifies the impact of the claims. A group of plaintiffs carries far more weight than a single individual, often leading to quicker settlements and more favorable outcomes. For instance, Diamond Resorts International faced a class action lawsuit over misleading sales presentations. The settlement not only canceled contracts but also provided financial refunds to class members.

Class actions don’t just help individuals recover their losses – they can also drive broader changes. By holding companies accountable for widespread misconduct, these lawsuits can lead to policy shifts that protect future buyers. If you serve as the lead plaintiff, you might even receive an additional incentive award for representing the group.

How to Qualify for a Class Action

To join a class action, your situation must align with others in the group. This means you need to have experienced similar harm, such as hidden fees, false promises, or aggressive sales tactics, from the same timeshare company. Your claims should involve the same legal and factual issues as those of other class members.

A specialized attorney can help determine if your case qualifies. For example, Aaronson Law Firm evaluates cases to see if they fit into existing class actions. Even if your timeshare purchase happened years ago, you might still be eligible under the Discovery Rule if the fraud only came to light recently.

If a judge certifies a class action, you’ll be notified of your right to join. You can also choose to opt out if you’d rather pursue your own lawsuit, which might lead to higher individual damages. To strengthen your case, gather all relevant documents – contracts, emails, and recorded conversations – before consulting an attorney. These materials not only support your claim but also benefit the entire class.

Conclusion

Taking legal action against a timeshare company requires strategic preparation, strong evidence of wrongdoing, and the support of a skilled attorney. It’s essential to pay close attention to deadlines, as legal options may still be available even after the cancellation period has passed.

Partnering with a lawyer who specializes in timeshare cases can give you the upper hand when dealing with large, well-funded corporations. Attorneys have the authority to subpoena internal documents, file legal claims, and safeguard your credit. As Aaronson Law Firm highlights:

"Unlike timeshare exit companies, we are actual attorneys. That means that we have a fiduciary and legal obligation to put our client’s interests first."

With over 20 years of experience, Aaronson Law Firm has helped countless individuals break free from costly timeshare contracts. Their 5.0 out of 5 star rating from 93 third-party reviews speaks to their dedication and success. They provide free consultations to assess your case, send legal demand letters under 15 USC 1681 to protect your credit, and offer full litigation services. Many clients have achieved contract cancellations in as little as four months – a testament to their ability to deliver results.

Whether you decide to file a lawsuit on your own or join a class action, having knowledgeable legal representation can mean the difference between ongoing financial strain and true relief. Don’t let deceptive sales tactics and false promises continue to weigh you down. Take the first step today with a legal team that knows how to fight for your rights and protect your financial future.

FAQs

What steps should I take if I think my timeshare contract is fraudulent?

If you think your timeshare contract might be fraudulent, it’s crucial to act fast. Start by collecting all the necessary paperwork, including the sales agreement, promotional brochures, and any correspondence you’ve had with the timeshare company. These documents could help highlight any misleading claims or deceptive practices.

Afterward, reach out to a timeshare attorney who specializes in such cases. They can explain your legal options and assess whether your situation involves illegal tactics, like high-pressure sales techniques or false guarantees. Protections under laws like the Federal Trade Commission Act might give you the chance to cancel the contract or even file a lawsuit if fraud is established. Keep in mind that timeshare agreements often come with strict deadlines for cancellation, so moving quickly is essential to safeguard your rights.

How do I find the right attorney for my timeshare lawsuit?

To find the right attorney for your timeshare lawsuit, it’s important to seek out legal professionals who specialize in timeshare law and have a solid track record with cases similar to yours. Expertise in timeshare cancellation and related legal issues can make a big difference in securing the representation you need.

The Aaronson Law Firm is dedicated exclusively to timeshare-related legal cases, including contract cancellations and litigation. They offer free consultations, giving you the chance to discuss your case and receive guidance on the best steps forward. This also helps you decide if their services align with your needs.

When evaluating attorneys, pay attention to their level of experience, client feedback, and whether they offer personalized support tailored to your situation. A firm with in-depth knowledge of timeshare law can guide you through the process efficiently while safeguarding your financial interests.

What are the advantages of joining a class action lawsuit against a timeshare company?

Joining a class action lawsuit against a timeshare company can be a smart move for several reasons. First, teaming up with other individuals in similar situations helps spread out legal expenses, making it a more budget-friendly choice. Plus, there’s strength in numbers – the combined voices of multiple plaintiffs can create a stronger case when tackling unfair or misleading practices.

That said, there are a few trade-offs to keep in mind. Settlements in class action cases are often smaller, as the payout is divided among all participants. Also, these cases can take longer to resolve compared to filing an individual lawsuit. Take the time to weigh these factors and decide what works best for your specific circumstances.

Related Blog Posts

- 5 Legal Methods to Cancel Your Timeshare Contract

- How Courts Handle Deceptive Timeshare Sales

- How to Document Timeshare Misrepresentation

- Class Action vs. Individual Lawsuits for Timeshare Fraud